NY Employee Paycheck Paycheck Stub and Bank Deposit Slip Example 2013-2026 free printable template

Show details

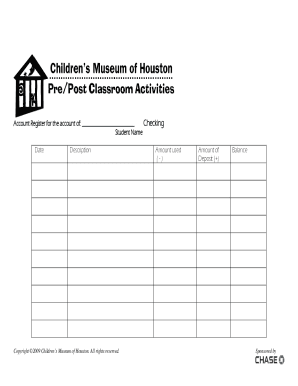

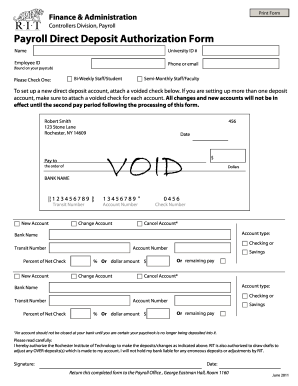

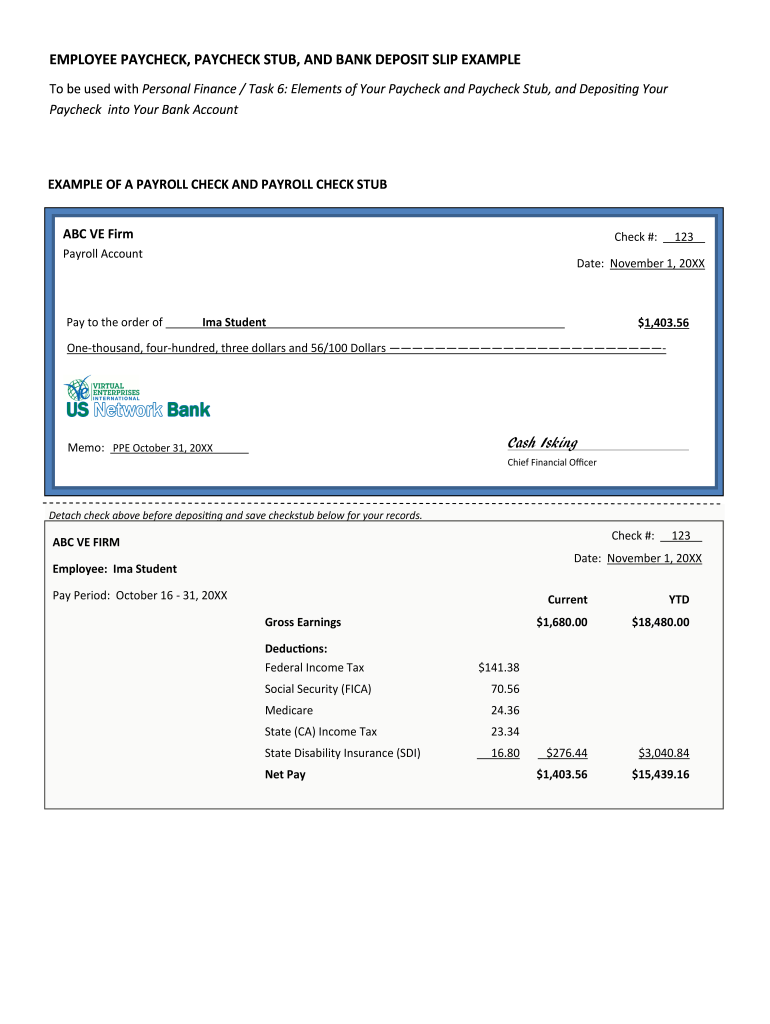

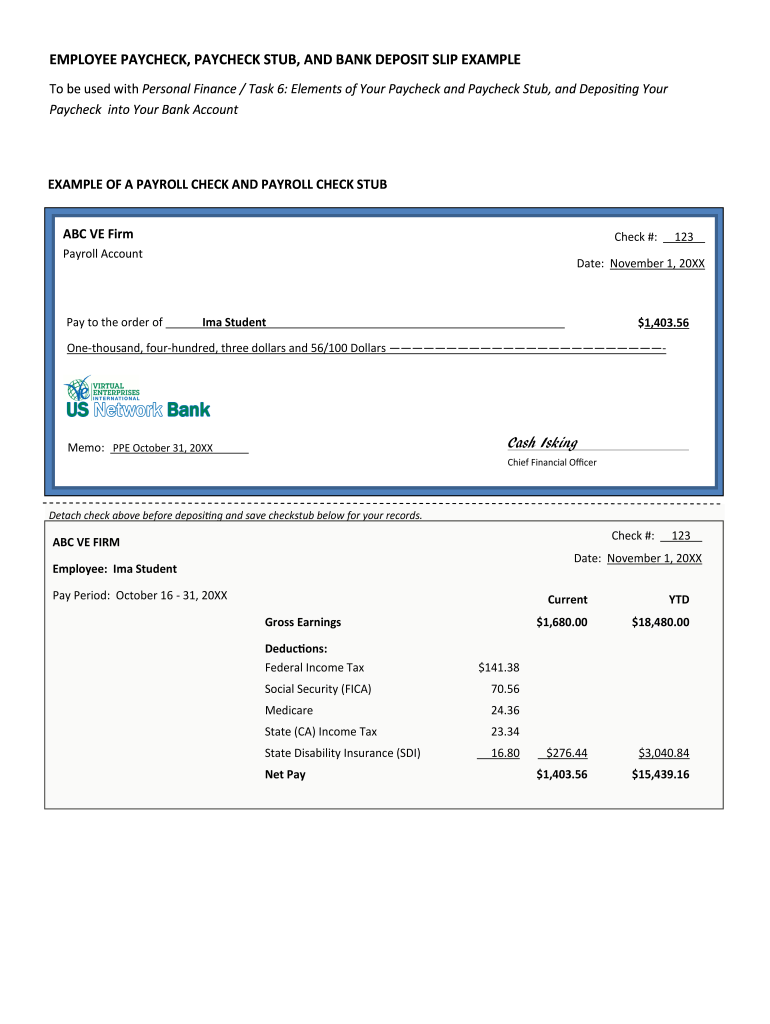

EMPLOYEE PAYCHECK PAYCHECK STUB AND BANK DEPOSIT SLIP EXAMPLE To be used with Personal Finance / Task 6 Elements of Your Paycheck and Paycheck Stub and Depositing Your Paycheck into Your Bank Account EXAMPLE OF A PAYROLL CHECK AND PAYROLL CHECK STUB ABC VE Firm Check Payroll Account Pay to the order of Date November 1 20XX Ima Student 1 403. 56 One-thousand four-hundred three dollars and 56/100 Dollars - Cash Isking Memo PPE October 31 20XX Chief Financial Officer Detach check...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign payroll check template form

Edit your online payroll check form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your create payroll checks form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit print payroll checks online online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit how to make a payroll check form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payroll check printing software form

How to fill out NY Employee Paycheck Paycheck Stub and Bank

01

Locate the paycheck stub and ensure it is for the correct pay period.

02

Fill in the employee's personal information such as name, address, and Social Security number.

03

Enter the employer's information, including name and address.

04

List the employee's gross wages for the pay period.

05

Deduct any pre-tax benefits, taxes, and other withholdings to arrive at net pay.

06

Include any overtime hours worked and corresponding pay.

07

Ensure the check date is correct and clearly printed.

08

Record any accrued time off or sick leave balances if applicable.

09

Double-check all figures for accuracy before finalizing the paycheck stub.

Who needs NY Employee Paycheck Paycheck Stub and Bank?

01

Employees who receive payments needs to verify their earnings and deductions.

02

Employers must provide accurate records for payroll purposes.

03

Tax authorities require documentation for income reporting.

04

Banks may need the stub for loan applications or financial verification.

Fill

how to make payroll checks

: Try Risk Free

People Also Ask about payroll check printing template

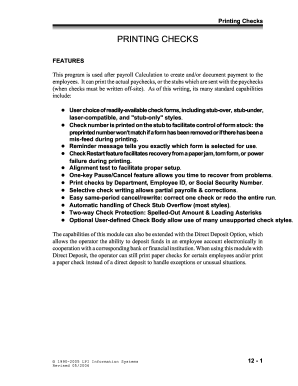

How do I print a payroll check?

How you can print payroll checks for employees Process payroll. Choose the check stock type in your payroll software. Load your printer with check stock and ink. Print payroll checks. Deliver to employees in a timely manner.

What printer can print payroll checks?

A MICR laser printer is used to print secure checks and financial documents. It uses laser technology to melt MICR toner onto the check paper to create secure MICR characters and other line items.

Can you print checks on a regular printer?

Yes, printing checks from your own printer is perfectly legal. However, they must be printed on special paper.

What do you need to print payroll checks?

To print payroll checks, you need to have the following handy: Software to print from. Payroll software. Check printing template or software. Check stock. Blank. Preprinted. MICR (magnetic) ink. Printer. Envelopes, if applicable.

Can a laser printer print checks?

You will need MICR ink for check printing on inkjet printers, and you will need MICR toner for check printing on laser printers. Above all, you need MICR ink and toner for safety; without it you are opening yourself up to unnecessary financial risk and vulnerability.

Can I print my own checks at home?

Is Printing Checks at Home Legal? Many people don't know this, but it's 100% legal to print your own checks. Not only is it legal, it's also easy to print your own checks. All you need to do is gather the right supplies and choose the best check printing software for your business.

Do checks have to be printed with special ink?

The Federal Reserve and all banks require that checks are printed with MICR ink or toner for ease of processing. Financial institutions read checks optically and/or magnetically, using MICR.

How do I get a payroll check?

Order Payroll Checks Order Payroll Checks. Order checks from the bank where you have your payroll account, or see if an office supply store offers cheaper payroll checks. If your state requires you to give employees a pay stub, you can order preprinted payroll checks with the stub attached from a stationery shop.

What kind of printer do I need to print payroll checks?

A MICR laser printer is used to print secure checks and financial documents. It uses laser technology to melt MICR toner onto the check paper to create secure MICR characters and other line items.

Do I need a special printer to print payroll checks?

You can print your own checks with almost any printer: inkjet, laserjet, even offset printers. Some check printers have special features that boost the security of your checks, like watermarks and even thermochromatic ink—but you can use any basic home-office printer, too.

Can I print payroll checks on regular paper?

Yes, you can print checks with almost any printer as long as it is compatible with magnetic ink. Using magnetic ink is required if you want a bank machine to be able to read your check.

Can you use any printer to print checks?

Can I print a check on a regular printer? Yes, you can print checks with almost any printer as long as it is compatible with magnetic ink. Using magnetic ink is required if you want a bank machine to be able to read your check.

Can you print a payroll check?

Many states have tried to eschew paper checks in favor of more efficient payment methods by allowing businesses to make direct deposit mandatory. You can print payroll checks using any printer as long as you have a few requisite supplies.

Do I need a special printer to print checks from QuickBooks?

All office printers for QuickBooks checks (excluding preprinted checks) must have MICR (Magnetic Ink Character Recognition) ink. This is required for the MICR line, the special numbers at the bottom of checks that include the account number, bank routing number, check number, and other details.

What ink is used for payroll checks?

If you're using blank check stock, you'll need magnetic ink character recognition (MICR) ink or toner. Purchase MICR ink for inkjet printers and MICR toner for laserjets. Those who purchase pre-printed check stock from their payroll software don't need MICR ink or toner.

Do you need a special printer to print payroll checks?

You can print your own checks with almost any printer: inkjet, laserjet, even offset printers. Some check printers have special features that boost the security of your checks, like watermarks and even thermochromatic ink—but you can use any basic home-office printer, too.

Can I just print a check on regular paper?

Printing your own business or personal checks is perfectly legal in the US, and no laws are prohibiting you from doing so.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit blank payroll check template from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including payroll checks templates. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I complete make a payroll check online?

pdfFiller has made it easy to fill out and sign payroll check maker. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I sign the create payroll checks online electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your printable payroll checks in seconds.

What is NY Employee Paycheck Paycheck Stub and Bank?

The NY Employee Paycheck Paycheck Stub is a document provided to employees that details their earnings, deductions, and net pay for a specific pay period. The bank refers to the method or account where the employee's salary is deposited.

Who is required to file NY Employee Paycheck Paycheck Stub and Bank?

Employers in New York are required to provide paycheck stubs to their employees, detailing earnings and deductions. All employers who pay wages to employees in New York must comply with this regulation.

How to fill out NY Employee Paycheck Paycheck Stub and Bank?

To fill out the paycheck stub, employers must include information such as the employee's name, pay period dates, gross wages, itemized deductions (taxes, insurance, etc.), and net pay. This information should be organized clearly for easy understanding.

What is the purpose of NY Employee Paycheck Paycheck Stub and Bank?

The purpose of the NY Employee Paycheck Paycheck Stub is to provide transparency regarding an employee's earnings and deductions, ensuring that employees are informed about their pay and allowing them to verify the accuracy of their wages.

What information must be reported on NY Employee Paycheck Paycheck Stub and Bank?

The paycheck stub must report information such as the employee's name, pay period, gross pay, net pay, itemized deductions (such as federal and state taxes, Social Security, health benefits), and dates of payment.

Fill out your NY Employee Paycheck Paycheck Stub and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payroll Checks With Stubs is not the form you're looking for?Search for another form here.

Keywords relevant to printable payroll check template

Related to make payroll checks online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.